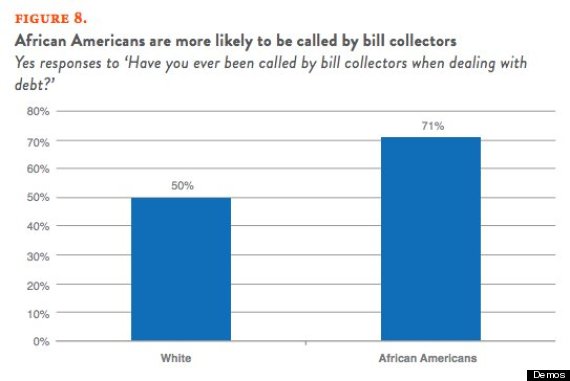

Debt collectors are calling African Americans more often than any other race, especially whites, according to a recent new survey. Despite both groups being reported as having equal debt amounts and repayment rates, African Americans were still targeted 21 percent more than white-Americans. Take a look at the graph below…

Think tank Demos and the NAACP Economic Department collaborated to survey moderate-income American households with some credit card debt for the study. Black Americans weren’t any more likely than whites to be late on a payment, the survey found, and they were also no more likely than whites to declare bankruptcy or get evicted.

So why is this happening? It’s not clear exactly why debt collectors seem to be going after one race more than the other, but the study did find Black Americans to have lower credit scores than white Americans, which might have a small part in the targeting process. That gap continues to get wider as a result of the financial crisis where subprime lenders were more likely to target African-Americans during the housing boom. Those loans, with higher interest rates, were more likely to default. The result: credit scores that could be marred “decades,” as the Washington Post pointed out in 2012.

“African-American households are more likely to have been called by bill collectors because they are more likely to have blemishes on their credit history that would send debts to collection agencies,” Catherine Ruetschlin, an author of the Demos report, wrote in an email to The Huffington Post.

The economic recovery hasn’t been kind to African-Americans: The unemployment rate for blacks (12.5 percent) is more than double that of whites (6.2 percent), according to the most recent jobs report. In fact, the jobless rate for blacks now is much higher than the overall unemployment rate in October 2009 (10 percent), the highest it got in the aftermath of the recession.

“Those disadvantages mean that African-Americans are more likely to face financial insecurity and have poor credit scores as a result,” Ruetschlin wrote.

Blacks also have a harder time than whites getting a home loan. They earn less than their white peers. They’re much more likely to live in poverty and less likely to have health insurance.

Mark Schiffman, a spokesperson for ACA International, a trade association of third-party debt collectors, defended his industry as “color-blind.” “They [the third-party agencies] don’t get into the ethnic information,” he told HuffPost. “Their job is to collect the debt, not give out the credit.”

Now, we want to hear your thoughts. Please leave your comment or question in the space provided below and share this newsletter with your friends and family on Facebook and Twitter. Your comments or question could be chosen as our featured Money Question Monday and a phone call by financial expert Heather Wagenhals could dial your way to be live on the Unlock Your Wealth Radio Show….

Original article courtesy of Huffington Post.