Employee fraud hotlines are on the rise, according to a recent study by the Association on Certified Fraud Examiners (ACFE), companies should focus their attention monitoring employee fraud.

One example in finance departments, reported from The American Genius, most misappropriation of funds occurs in the procurement, payment, and expens areas, and by analyzing transactions in the areas, the ACFE says business can test for a wide range of employee fraud schemes, conflicts of interest, and even bribery.

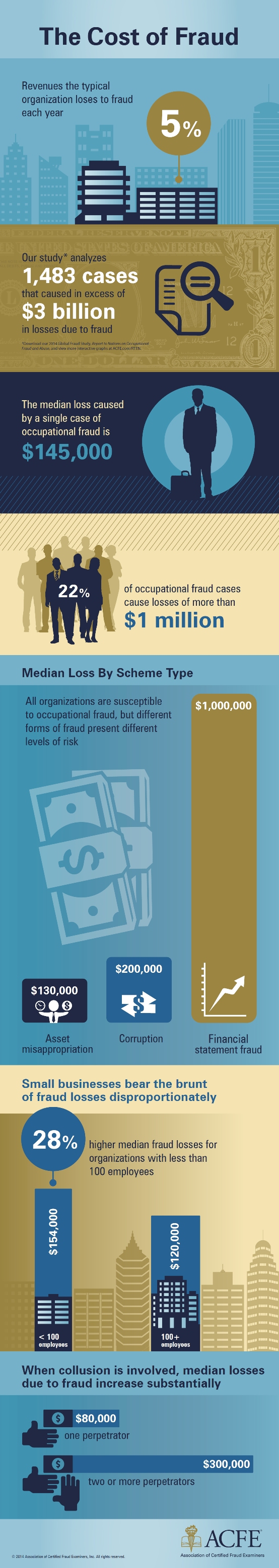

The article continues on, disclosing information from association reports that many companies use external audits to seek out fraud, yet only 3.0 percent of the 1,438 fraud cases were caught by these types of audits. More than double that amount (7.0 percent) were discovered by accident rather than by external audit.

It appears that the most effective way to catch a corporate criminal is through employee fraud hotlines, according to the ACFE, as over 40 percent of all cases reported in the study were detected via tip, typically from employees within the organization being defrauded.

There are “red flags” that most fraud perpetrators display, which is likely the reason coworkers are their undoing. For example, ACFE notes that the most common behaviors among perpetrators were living beyond one’s means (43 percent), having financial difficulties (33 percent), maintaining an unusually close association with a vendor or customer (22 percent) and “exhibiting control issues with an unwillingness to share duties (21 percent),” all of which are easier to spot by someone sitting in the next office every day than a third party auditor.

While anti-fraud controls are still useful, smaller businesses are vulnerable to fraud because these anti-fraud controls are often skipped, and smaller organizations actually have a slightly higher median loss from fraud cases ($154,000) compared with companies of all sizes, and those funds are less likely to be recovered from a small brand.

How to safeguard your brand

Although the ACFE promotes third party audits, anti-fraud controls and tools, the real gem in this study is that coworkers on the front line are the best way to sniff out fraud.

Whether your company has 10 or 10k people, offering a culture that allows for anonymous tips is critical to avoid being defrauded. Whether it is through meetings that you as a leader inform all team members to be on the lookout for the most common behaviors of a fraudulent employee, and that they are encouraged to come forward to report it, even if anonymously (tell them to send smoke signals or drop an anonymous handwritten note if they must).

Your company will be better for it, and you’ll hold on to more of your money.

Now, we want to hear from you! Would like to share your opinion or make a comment on the Unlock Your Wealth Radio Show? If so, then please leave your comment or questions in the space provided below and share this article with your friends and family on Facebook and Twitter. Your comments or question could be chosen as our featured Money Question Monday and a phone call by financial expert Heather Wagenhals could dial your way to be live on the Unlock Your Wealth Radio Show.

Source: Property Casualty 360

For a complete copy PDF of the study, go to ACFE.com/RTTN.