The number of migrant employees continues to grow as well as globalization and the online worlds which have all facilitated the money transfer industry to turn out to be a US $250 billion a year industry.

The number of the money transfer industry will probably increase over the upcoming years also, the present growth level is 10-12% a year.

RELATED: Estate Planner Accused of Wire Fraud

This obviously has result in increasingly more companies engaging in an already fragmented money transfer industry and they are normally all keen to get their piece of the revenue. Obviously everyone wants to make savings but the cheapest company might not always be the best choice.

Below are some tips that will assist you transfer your hard earned money safely:

1) First check how big is the company. If the company is a whole new outfit having only a couple of members of employees in a house office then there is probably going to be a greater possibility of something going wrong with the transfer. A medium to big sized company would possibly be a much better bet.

2 ) For a large amount of money, it will be generally accepted that a bank wire transfer is the most secure procedure for sending your money. The major causes for this are that

Almost all customers will have had to provide proper forms of identification

The authentic wire transfer message is sent out to another bank in the form of an and analyze.

3 ) Never ever send money to unknown people and individuals who you do not know. The most likely time period for this to happen would be from an internet auction or from other online purchases. Almost always there is the chance that they will simply get the money and run.

4 ) Be aware of e-transfer fraud email, which is also called phishing scams. These are generally entered into first whenever someone receives an email which pretends it is from an authentic business that may usually need your personal and financial information for example a bank, Western Union, Paypal, and so on.

The structure and presentation of the e-mail may be very difficult to tell apart from the genuine business. Obviously on this occasion the email is a copy and will possibly aim to get you to click on a web link which will forward you to a different fake website again appearing very genuine. Here they would attempt to get crucial personal/financial information from you. The best way to stay away from such frauds is to simply go direct to the merchants website and not by means of a link in an e-mail.

RELATED: 5 Ways to Protect Your Finances From Money Transfer Frauds

5 ) In order to avoid money transfer fraud, you should check if the company answer the following questions promptly and easily:

What exactly is the exact charge and exchange rate for the money transfer?

How will the funds physically end-up in the hands of the suggested recipient?

extremely secure encrypted message which is hard for anyone to intercept

When will the money become available?

Are there any specific extra fees for using bank cards?

Are you a victim of fraud or money scam? Share your story with us on the Money Credit and You Facebook page!

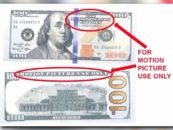

Original article and photo published in the Chicago Tribune.